HF Group saw a 138 percent growth in 2022 to post a sh.256.7 million full-year net profit compared to a sh.682.7 million loss in December 2021.

The growth was fuelled by a stellar performance by the Group’s banking subsidiary, HFC, whose profit after tax grew by 147 percent to sh.178.2 million in 2022 from a loss of sh.381.3 million in 2021.

Interest income grew by sh.347 million while Interest Expense increased marginally by 1%, an equivalent of sh.15 million.

The Group’s interest-earning assets grew by sh.3.6 billion while the average yield on these assets improved year on year to 10% from 9.6% in December 2021.

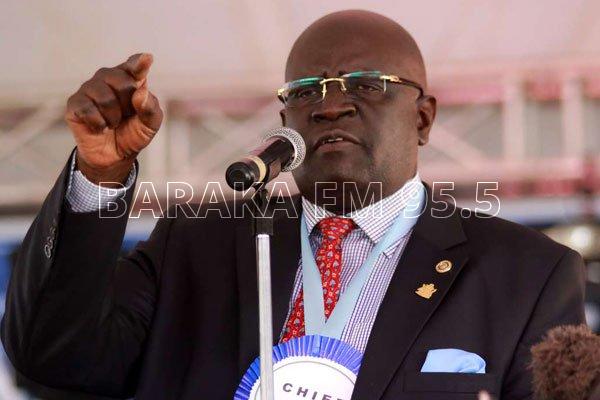

While releasing the results in Nairobi, HF Group CEO Robert Kibaara said deposits grew by sh.1.5 billion during the period that was characterized by a steep rise in interest rates.

“Our performance reflects the relentless focus we have put on our business transformation strategy. Our diversification to full-service banking has seen the Group maintain a flat interest expense line while growing customer deposits and significantly increasing our funded and non–funded income,” said HF Group CEO, Robert Kibaara.

Despite a 13 percent growth in staff costs to support new business segments, the Group’s total expenses dropped by sh. 472 million (14 percent) year-on-year highlighting the success of a cost optimization program.

“We continue to invest in people and technology, speeding our capacity building and digital transformation in order to enhance customer experience,” he said.

Foreign exchange income rose by 182 percent underscoring the bank’s new focus on the SME market as the benefits of full-service banking continue to stream in.

The profit-making streak was recorded across all Group subsidiaries with the property development subsidiary revenue growing by Kes 321 million supported by growth in project management fees and commissions.

The Group’s bancassurance subsidiary (HFBI) posted a 12 percent growth in profit before tax to reach sh.7.5 million.

The Group CEO has exuded confidence in sustained profit-making across all business units driven by revenue diversification and the deepening of its full-service banking.

“As we embark on 2023, we have an optimistic outlook on our performance. Revenue diversification is expected to accelerate as the Group continues to roll out SME and Personal Banking offerings and project management initiatives, and this is expected to continue facilitating access to cheaper funding for the franchise,” Kibaara concluded.