The 2022 outlook for the commercial office sector is negative.

According to the Status of the Built Environment report for the period July – December 2021, the Commercial Office Sector was among the sectors in real estate that were adversely affected by the COVID-19 pandemic.

The report by the Architectural Association of Kenya was released in Nairobi on Tuesday 1st February 2022.

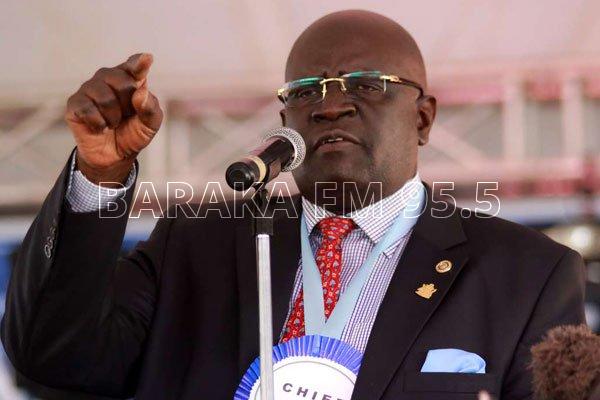

Speaking during the launch, AAK President Wilson Mugambi said that most service-based companies have now wholesomely embraced work-from-home policies with the primary objective of reducing employee commute times and improving productivity.

“Underutilized real estate attracts immediate attention and with the increasing recognition of the possibilities in the virtual spaces we have observed increased contraction of expensive and premium office spaces,” said AAK President Wilson Mugambi.

“Moving into 2022, our OUTLOOK for the commercial office sector is NEGATIVE as the sector’s performance continues to be constrained by the oversupply of over 6.3 million SQFT of space and declining rental yields as at the first half of 2021,” he added.

Meanwhile, the 2022 outlook for the retail market is also negative given the decreased demand for physical shops following the pandemic. This was occasioned by the increase of online shopping which was driven by lockdowns, border closures, and international export/import restrictions which put pressure on all aspects of the supply chain.

“Many consumers have moved online for essential goods, forcing supermarkets to upgrade their delivery capabilities. Consumers will continue to prioritize delivery and convenience with an eye out for good deals, ease of ordering, and free or cheap delivery,” read the SBE report.

With the uncertainty occasioned by the Omicron virus, the demand for physical shops and retail units might experience decreased demand. The situation may be compounded by the increased adoption of the concept of the dark kitchen that had started to gain traction locally during the initial phases of the COVID-19 lockdowns. The dark kitchen concept has seen restaurants convert their kitchens for back-end order fulfillment designed for inner-city pick up or delivery for online shopping platforms.

“Understandably, the physical retail isn’t dead but we are seeing a gradual reallocation of space. Investors are interested in mixed-use projects with the flexibility to respond to market changes. Local stores will continue to play a larger role in the delivery of goods and services,” said AAK President while releasing the report.

“Therefore, our 2022 OUTLOOK for the retail market remains NEGATIVE in the interim but NEUTRAL in the medium term if the COVID-19 situation will be arrested before maximum damage,” he added.

However, in the period July – December 2021, industrial properties performed better hence seeing slow growth in the industrial market in Mombasa, Nakuru and Nairobi at 1 percent, 2 percent and 3 percent respectively.

“Providers of warehousing (Grade A) will attempt opening new spaces (2,000 to 5,000sqm) in more locations outside Nairobi and Mombasa which have traditionally been the industrial bases for most companies. They are likely to succeed,” read the SBE report.

While retailers and logistics operators are making progress on improving last-mile fulfillment, researchers suggest a more permanent movement from the last mile to last hour in the not too distant future.

“This will likely benefit industrial locations in Nakuru, Naivasha, Kisumu, Mombasa and Nairobi that have traditionally been the hubs for industrial development in the country. Thus, our OUTLOOK for the industrial segment of the country’s real estate sector is POSITIVE,” said Mugambi.

The 2022 outlook for the hospitality sector is neutral as AAK projects that leisure-oriented hotels accessed by local markets will recover before hotels dependent on international and business travel. In addition, hotel operators may be able to keep cost growth subdued due to forced innovations implemented during the pandemic, therefore supporting more robust profit growth as revenues rebound.

The COVID-19 crisis has triggered a number of structural changes in the real estate market. For instance, if (part-time) home working remains a normal part of working life, this will change the wishes of residents, while the owners of office buildings will have to rethink the function of their offices.

Similarly, the retail sector will have to respond to the acceleration of the growth in online sales and hotel operators would be wise to look for alternatives if businesses across the world switch to digital meetings on a larger scale.

Also at the SBE report launch was Housing and Urban Development Principal Secretary Charles Hinga who called on Planners to be more involved in the country’s development.

In his remarks, the PS highlighted that the residential real estate grew in the last half of the year. This was also supported by the SBE report which reveals that small-size family residential units (i.e. one and two-bedroom houses) were in high demand.

“In 2017, President Uhuru Kenyatta’s government embarked on an ambitious program aimed at building 500,000 affordable housing units as part of the Big Four Agenda. Four years later, 2,235 affordable housing units have been occupied with several other units currently under construction. Of the 2,235 units, 1,370 units are at Park Road Ngara while Kisumu, Mavoko and Machakos have 250,463 and 52 of their affordable housing units currently occupied.”

He also said that in August 2021, the UK Climate Investments (UKCI) and FSD Africa Investments (FSDAI) confirmed a sh.5.2 billion funding commitment to the Kenyan green affordable housing venture.

“The initiative is targeted at the delivery of approximately 10,000 homes using modern green technologies. Accordingly, the housing units will provide affordable ownership and rental opportunities with 100 percent ownership to Kenyans.”