Have you ever checked whether you have unclaimed financial assets?

Do you know of any unclaimed financial assets under your name or relatives name?

According to the Unclaimed Financial Assets Authority (UFAA), Kenya has sh.50 billion worth of unclaimed assets held by the authority.

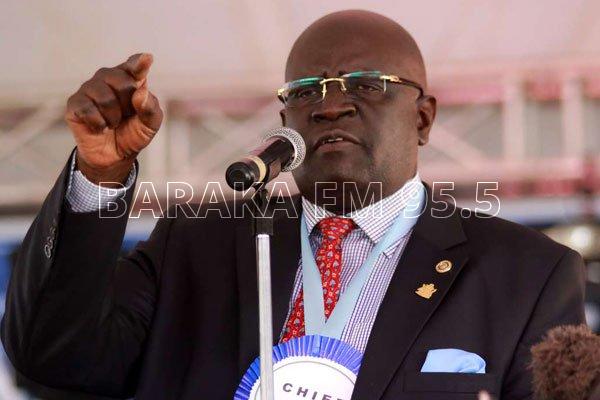

Speaking during a press briefing in Nairobi on Wednesday, UFAA chairperson Richard Kiplagat said most Kenyans are not aware that they have unclaimed assets.

“Many have told us that they are not sure what asset classes are covered by unclaimed financial assets. It is important that we clarify that not only do we receive cash in bank accounts, but we also cover insurance policies, safety deposit boxes, and uncashed bankers cheques as unclaimed financial assets,” said UFAA chairman Richard Kiplagat.

Even the caution money one left when leaving school and the money left in schools when one drops out becomes an unclaimed asset after two years.

Initiatives to Create Awareness

Given the lack of knowledge on a majority of Kenyans about their unclaimed assets, the Authority has partnered with the Huduma Kenya secretariat. The move aims to bring their services closer to the people.

In the desire and need to be much more customer friendly and accessible, the authority will be partnering with Huduma Kenya secretariat to make services available across Huduma centers in all the 47 counties.

“This will assist us to provide much more efficient and effective services as we will also be training the Huduma officers to guide the public on the reunification process, so you don’t just go and collect form but also get advise on how you can be supported in the process,” said Chairman Kiplagat.

“We are also going further to see how it is possible to assist the claimant with additional services necessary to complete the reunification application and successfully file for the reunification funds,” he added.

The Authority has launched the Unclaimed Assets Management Information system that will allow doing away with manual filing of claims and facilitate easy processing of claims. The system will boost the reporting feedback mechanisms and make it easier to submit claims to the authority whether one is in the country or not.

According to Chairman Kiplagat, the system will also facilitate trust fund management and reporting.

Call for institutions to file unclaimed assets

Institutions holding unclaimed assets have been urged to file them with the Authority before the deadline of 1st November.

According to Chairman Kiplagat, a survey by the Authority in 2019 revealed that there are over 400,000 institutions in the country holding unclaimed assets worth over sh.200 billion.

“We are aware that there is limited number of institutions that have been complying with the legal responsibility to declare and remit the assets they are holding,” said Kiplagat.

He said they are working closely with the Office of the Auditor General to ensure institutions file unclaimed assets.

Claiming Assets

One can log into the Authority’s website to check whether they have unclaimed assets. You can also do so by dialing *361#.

There are four types of claims i.e. claiming as an original owner, on behalf of someone (beneficiary or deceased), on behalf of a business entity and on behalf of a minor.

“Claimants must fulfil requirements of the law before being reunited with their claims,” said Chairman Kiplagat.

In 2016, there were 416 claims made. The number almost doubled in 2017 and has continued increasing since then.

This year alone 6,000 claims have been made and at least one billion shillings paid out.

“Every year we are taking significant strides to double the number of claims,” said the Chairman.