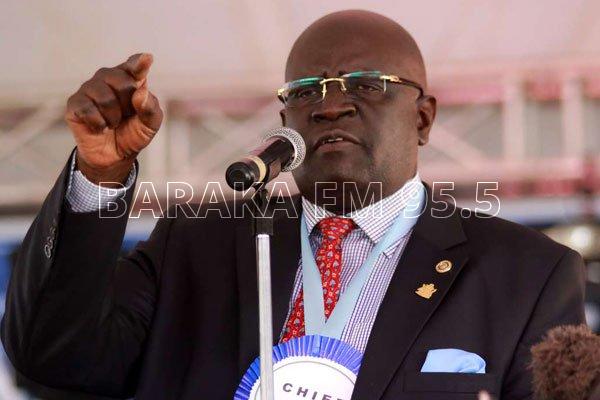

The government will work with Credit Refence Bureaus (CRB) to come up with new regulations to eliminate black listing.

Speaking on Tuesday after being sworn in, President William Ruto said the government was working with CRB on a new system of credit score rating.

“Our starting point is to shift the Credit Reference Bureau framework from its current practice of arbitrary, punitive, all or nothing blacklisting of borrowers which denies borrowers credit,” said President Ruto.

The Head of State said that the new system of credit score rating will provide borrowers with an opportunity to manage their credit worthiness.

President Ruto also addressed complaints about the burden traders face while doing cash transactions exceeding one million shillings.

“Many have reverted to storing money under their mattresses at a great risk, which is clearly not the intention, of the anti-money laundering regulations,” said President Ruto.

“While we remain fully committed to mitigating this risk, we believe there is a scope to make compliance less burdensome on genuine business transactions,” he added.

Ruto added that work was ongoing at the Central Bank on how to ease the burden without compromising the security of the financial system.

Establishment of Ministry of Cooperatives and SME Development

The government will be establishing a Ministry of Cooperatives and SME Development.

President William Ruto says the Ministry will deal with Micro, Small and Medium Enterprises and credit issues.

The Commander In Chief said that they will implement the ‘hustler fund’ dedicated to the capitalization of micro, small and medium enterprises through chamas, sacco and Cooperatives to make credit available on affordable terms that do not require unnecessary collateral.

“To implement all these interventions, we shall establish a Ministry of Cooperatives and SME development mandated to ensure that every small business has secure property rights, access to finance and a supportive regulatory framework,” said the President.