KCB Group Plc recorded a historic 74% rise in profit after tax for the full year ending December 2021, riding on economic recovery across markets.

Net profit grew to KShs.34.2 billion compared to KShs.19.6 billion a year earlier, on the back of increased income, cost management and lower credit provisions which saw the Group post higher returns to shareholders.

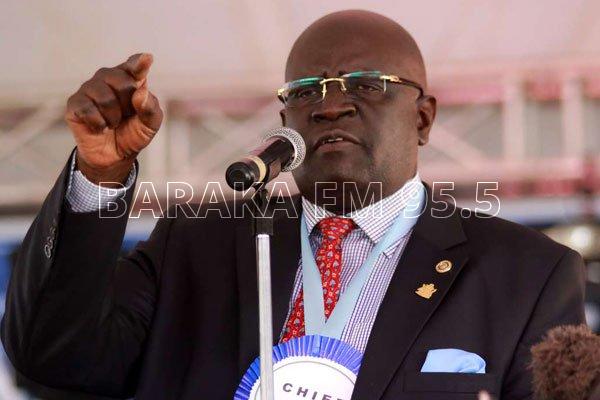

Group CEO & MD Joshua Oigara said KCBV made significant progress in achieving their 2021 strategic targets which delivered a strong financial performance that was in line with gradual economic recovery across all markets.

“During the period, we deliberately focused on supporting customers to weather the healthcare storm. We expect good business momentum this year with a projected economic recovery across markets”.

Income

Revenues increased by 13.5% to KShs.108.6 billion on account of a rise in net interest income which was up 15.0% to KShs.77.7 billion. Non-funded income grew by 9.9% to KShs.30.9 billion on increased customer transactions, FX income and income from accelerated loan growth.

Costs

Costs went up by 11.9% to KShs.47.8 billion from KShs.42.8 billion on account of an increase in staff and organizational costs, consolidation of Banque Populaire du Rwanda (BPR) and inflationary adjustments across the group. Other operating expenses increased marginally by 2.8% to close at Kshs 22.9B from Kshs 22.3B last year with improved cost management across the Group.

Key Financial Highlights

· Profit after Tax – Up 74% to KShs.34.2 billion compared to KShs.19.6 billion.

· Revenue – Increased 13.5% to KShs.108.6 billion on account of increase in interest income driven by increase in earning assets, non-funded income, and lower cost of funding.

· Costs – Up by 11.9% to KShs.47.8 billion.

· Total Assets – Increased 15.4% to KShs.1.139 trillion.

· Customer Loans – Increased by 13.5% to KShs.675.5 billion through organic and strategic acquisitions. • Customer Deposits — increased 9.1% to KShs.837.1 billion due to organic growth mainly in the Kenyan market