Equity bank has signed a Kshs 11 Billion loan facility with Team Europe, Germany’s DEG, the Netherlands FMO and the UK’s CDC Group to cushion small businesses MSMEs during the three years the COVID-19 pandemic is expected to adversely affect the business operating environment.

In response to the COVID-19 crisis, Equity launched an offensive and defensive approach to support customers to sustain themselves while innovating alongside MSMEs who are leveraging on the opportunities that have presented within the crisis.

The Group committed to loan repayment accommodation for up to 45% of the customers whose cash flows and operation cycle were deemed likely to be negatively impacted during the COVID-19 pandemic.

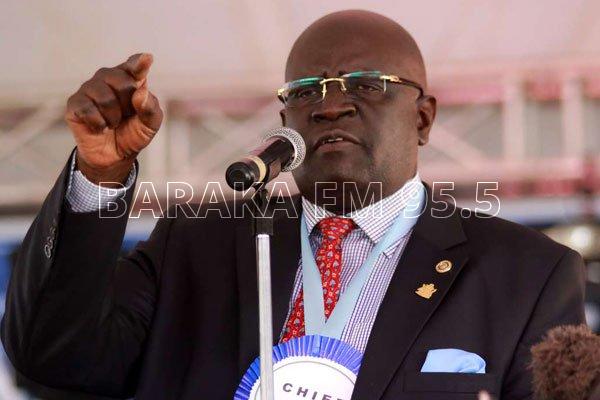

Equity bank CEO Dr. James Mwangi, said the loans will offer a lifeline to business owners affected by the great economic slowdown and keep the economy going in order to sustain lives and livelihoods and facilitate the recovery of businesses as the economy begins to reopen.

“The impact of the COVID-19 pandemic started as a health crisis, and quickly became an economic and humanitarian crisis that has seen more than 40% of Kenyan micro, small and medium “, he said.