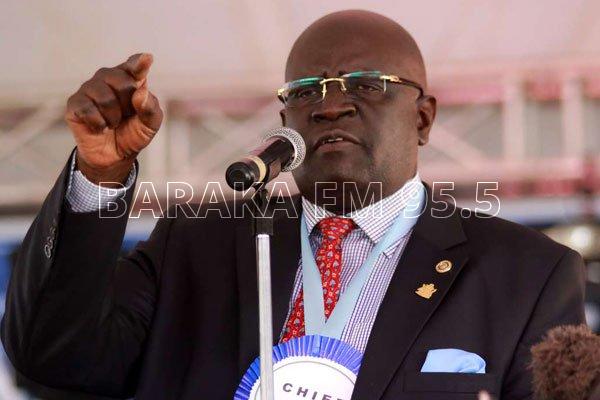

President Uhuru Kenyatta on Wednesday announced new financial measures to be taken to cushion Kenyans during this COVID-19 pandemic.

The new measures include the Executive Arm of the Government taking a salary cut, starting from the President and his deputy.

“In sharing the burden occasioned by the present global health pandemic, over the duration of the global crisis and commencing immediately, my Administration has offered a voluntary reduction in the salaries of the senior ranks of the National Executive,” said President Kenyatta.

The President and Deputy will take an 80 percent salary reduction, while Cabinet Secretaries and Chief Administrative Secretaries’ salaries will be reduced by 30 percent. Principle Secretaries will have their pay reduced by 20 percent.

“I call on the other arms of Government and tiers of Government to join us in this national endeavour, by making similar voluntary reductions; which will free-up monies to combat this pandemic,” said the head of State.

Tax Reductions

In order to protect people’s jobs and provide certainty for both employers and employees, the President ordered the National Treasury to implement certain directives including a 100 percent tax relief for Kenyans earning up to sh.24,000.

“I recognize the anxiety that this pandemic has caused millions of Kenyan families; many fearful of what the future may hold for them and their children, and the possibility of job losses and loss of income weighing heavily on their minds,” said President Kenyatta.

The treasury will also be needed to reduce the income tax rate or Pay As You Earn (P.A.Y.E) from its current maximum of 30 percent to 25 percent.

Resident Income Tax (Corporation Tax) has been reduced from 30 percent to 25 percent; while turnover tax (ToT) rate for Micro, Small and Medium Enterprises (MSMEs) has been cut from the current 3 percent to 1 percent.

“Appropriation of an additional sh.10 Billion to the elderly, orphans and other vulnerable members of our society through cash-transfers by the Ministry of Labour and Social Protection, to cushion them from the adverse economic effects of the COVID-19 pandemic,” the President directed.

For those (individuals, MSMEs and Corporate entities) that had borrowed loans and were overdue or in arrears by 1st April, 2020, President Uhuru Kenyatta has directed temporary suspension of the listing with Credit Reference Bureaus (CRB).

The National Treasury shall cause immediate reduction of the Value Added Tax (VAT) from 16 percent to 14 percent, effective 1st April, 2020.

“All Ministries and Departments shall cause the payment of at least of sh.13 Billion of the verified pending bills, within three weeks from the date hereof. Similarly, and to improve liquidity in the economy and ensure businesses remain afloat by enhancing their cash flows, the private sector is also encouraged to clear all outstanding payments among themselves; within three weeks from the date hereof,” said President Kenyatta.

Kenya Revenue Authority (KRA) will also be needed to expedite payment for all verified VAT claims amounting to sh.10 billion within three weeks; or in the alternative, allow for offsetting of withholding VAT, in order to improve cash flows for businesses.