Equity Group Holdings registered a 14 percent loss of Kshs.900 million after-tax in the first quarter of 2020, compared to a similar period last year, owing to non-performing loans occasioned by the economic impact of the COVID-19, the group, said in a statement on Thursday.

The bank’s profit before tax and the loan provisions was up by 10 percent to Kshs.10 billion between January and March 2020, an increase from Kshs. 9.1 billion last year, but loan loss provision increased tenfold to Kshs. 3 billion from Kshs. 300 million the previous year leading to the 14 percent decline of profit after tax.

This drop implied a decline from sh. 6.2 billion in the first quarter of last year to Kshs.5.3 billion after-tax, during the same period this year.

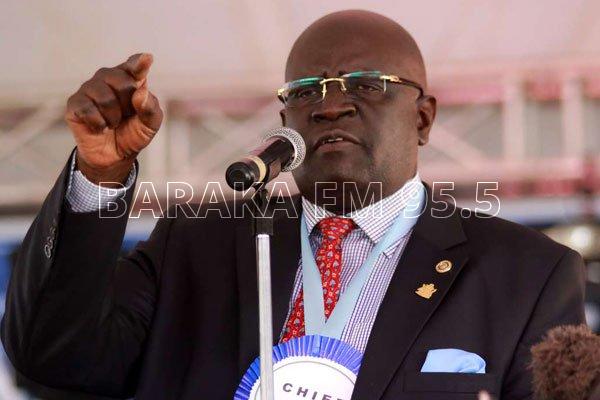

“The global COVID-19 pandemic has mutated into a global economic crisis, occasioned by a sudden standstill of economic activity as a result of the global lockdown. This has introduced unprecedented uncertainty within the global financial systems,” James Mwangi, the Bank’s managing director, said in a statement.

The bank group however continued to enjoy robust growth with total assets registering a 14 percent growth to Kshs. 693.2 billion from Kshs. 605.7 billion last year.

Mwangi said this growth was driven by a 17 percent growth in customer deposits to Kshs. 499.3 billion from Kshs. 428.5 billion during a similar period last year.

“The Group stands well positioned to confront the challenges of the COVID-19 disruption that is mutating into an economic, financial, and humanitarian crisis,” Mwangi, said.