Small and medium enterprise owners who have been finding it difficult to access loans from mainstream banks can now get funding through Stawisha program.

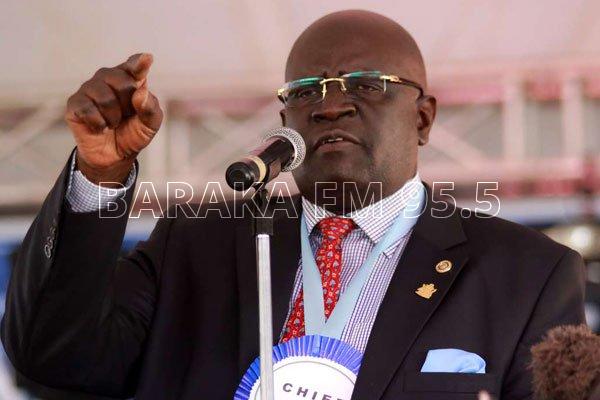

Trade Chief Administrative Secretary Lawrence Karanja said four billion shillings has been consolidated for the Stawisha Mashinani SME fund.

“The project will be implemented by five institutions i.e. Micro and Small enterprise Authority (MSEA), which will be harmonizing and promoting the policies, they will also be in charge of educating and training the SME owners,” said Karanja.

The Kenya Industrial Estates (KIE) will offer incubation and credit facilities; IDB Capital will be giving long term credits while the Industrial and Communication Development Corporation (ICDC) and Kenya National Trading Corporation (KNTC) will be providing support in trading activities and industries and commercial enterprises.

The program which was launched by President Uhuru Kenyatta on Friday last week targets about 400 SMEs with an exposure of about five to ten million shillings in loans.

“One of our biggest problems we have in this country is access to credit for anybody who wants to start a business or anything that would be income generating,” said Industrialization Principle Secretary Francis Owino.

“The fund will be like incubation because some of them cannot access loans from mainstream banks. We will be giving them like a start off so that later when they take off they can approach the mainstream banks,” he added.

The program meant to strengthen SMEs at the grass root levels will not only be providing loans but also training.

“There will be the softer element of capacity and skills development and training so that they are able to run their businesses better,” said KIE Managing Director Parmian ole Narikae during the signing of a Memorandum of Understanding between the five agencies.

“Training on how to manage money, how to market, handle staff etc., which will also reduce the mortality rates of SMEs so that they are able to grow,” he added.

Once you have received the loan, you will have a grace period of up to two years to repay the loan.

“For some of the enterprises especially those going into manufacturing and agro processing, we will have a moratorium within which they do not have to pay the principle but only the interest,” said IDB Managing Director Karen Kandie.