Nairobi, KENYA: A 2014 report by the World Economic Forum has shown that entrepreneurship decreased unemployment by 20%, attributing this to the fact that high impact entrepreneurs grow faster, create more jobs, contribute to society, and transform industries to a greater extent than their peers.

The report further indicated that two out of four percent of entrepreneurs can be considered as the driving force behind 40% of all total jobs created.

A report by Endeavor and SAP 2015 also shows that the solution to Africa’s problems lies in wealth creation by high-impact entrepreneurs.

In Kenya alone, about 7.5 million enterprises contribute approximately 45% to the Kenyan GDP, a number that is likely to drop if high-impact entrepreneurship model is not embraced.

Kenya needs to create at least 3.9 million jobs for young people by 2020, according to a recent report, which puts the total number of Kenyans who are currently unemployed at 1.5 million against a population of 48 million.

Speaking during the launch of the book titled High-impact entrepreneurship in the financial sector in Nairobi on Monday, Professor Dana Redford, the book’s editor and President of the Policy Experimentation and Evaluation Platform (PEEP), noted that a viable financial sector is a key condition for wider economic growth, adding that finance is a vital component of the entrepreneurial ecosystem surrounding new venture creation.

The book reveals a region that, despite many challenges, has seen tremendous growth in recent years and is rapidly becoming a global powerhouse.

“The cases presented in the book of high-impact entrepreneurship in the financial sector such as the stories of Banco Unico in Mozambique, Fidelity in Ghana, and Banco Atlantico in Angola, or the incredible journey of Kenya-based Equity Bank, show us the opportunities that vibrant African societies present for risk takers,” said Dana Redford.

A case study on Equity Bank, which is featured in the book, showcases ways in which the bank is a strong partner for aspiring entrepreneurs and how it promotes financial inclusion.

The book focuses on how the bank has approached its customers using an entrepreneurial mindset and culture, a pre-condition for the success of any business.

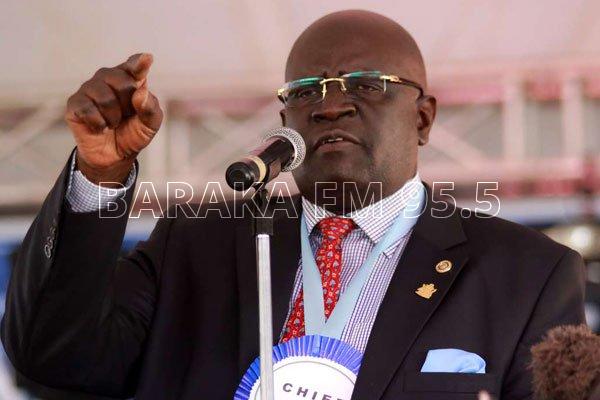

Commenting on how Equity Bank has fostered entrepreneurial growth, CEO and MD Dr. James Mwangi said that the bank’s humble beginnings inspired its positioning and contributed to the success the bank currently enjoys.

“Our past, present and future success require that we adopt a high impact entrepreneurial mindset and a corporate culture that inspires innovation and “intrapreneurship,” said Dr. Mwangi.

Dr. Mwangi also pointed out that So far, Equity Bank has trained close to 1.6 million entrepreneurs including farmers, women, youth groups, and micro-, small- and medium-sized enterprises through various initiatives led by the Equity Group in partnership with the Mastercard Foundation and the International Labour Organisation.